It is commonly accepted that shorting the volatility ETNs is a crowded trade. Is this true and what, if anything, does it mean?

First, we need to note that these ETNs are backed by VIX futures which are cash settled and, as futures have no fixed issuance, a traditional short-squeeze can't happen. As the demand increases, the authorized participants can just create new shares. There is no limited supply as there would be with a stock or a physically settled future.

It is also important to notice that all of these volatility products are derivative based. For every short there is a long so we could also say there is a crowded trade on the long side. While current short interest in VXX is about 85% of shares outstanding (compared to a heavily shorted stock like TSLA where the short ratio is only 27%), I can't see this as the root of any problem. If we take into account the futures, variance swaps and options the total short ratio of the volatility market has to be 100%.

The longs have been losing for years. A big difference is that the longs at least have asymmetry on their side. But make no mistake here, option market makers (who basically act as decomposers in this ecosystem) are choking on long volatility positions. The other difference between longs and shorts is that a lot of these trades are being initiated by the shorts. The market makers aren't deliberately buying, they are just passively incurring longs.

Given all this, is there a potential problem with the number of shorts? Maybe. It all comes down to who blinks first. Will the shorts cover aggressively, exacerbating any volatility spike? Or will the market makers be too eager to take profits and kill the move. And this effect could now be an issue because total open interest in volatility products has certainly grown. Given the very short term focus of market makers I tend to think they will sell before the shorts will buy (just like the situation where option market makers compress realized volatility through their hedging while customers will tend to let the market run against them further).

But we might be able to do more than speculate. The shorting of volatility ETNs really began to take off in 2012. Figure One shows the short interest of VXX in millions.

Figure One: VXX short interest.

If the shorts are easily spooked and cover aggressively on rallies, we should notice a pattern. Volatility rallies should have grown larger as the open interest in volatility has grown. To test this, I calculated the average of daily rallies and declines of the VIX, and looked at that ratio since 1990. This is shown in Figure Two.

Figure Two: The ratio of average up moves to average down moves for the VIX.

It is hard to make an argument that the relative up moves are increasing. While 2014 was the 3rd highest year, 2015 and 2016 were closer to the bottom the range. Overall, the average pre-2012 ratio was 1.208, and afterwards it was 1.213.

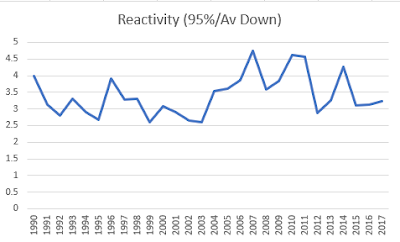

Maybe the effect is confined to large moves, where shorts are more likely to cover. In Figure Three I graph the ratio of the 95th percentile of up moves to the average down move.

Figure Three: The ratio of the 95th percentile of up moves to average down moves for the VIX.

This doesn't appear to show that in the last 5 years shorts have been more inclined to cover. It looks to me that the new volatility shorts behave very much like the old ones.

As with any trade, it is important to have an exit plan in place. Further, being short volatility exposes you to negative skewness. But I don't see that the increased interest in volatility ETNs has added more risk.

Summary:

- Short interest as a percentage is meaningless.

- The important thing is the way shorts cover on volatility rallies.

- There is no evidence that short covering is exacerbating these moves.

This is a very good paper about short vol (a crowded trade?)

ReplyDeletehttps://t.co/QLm00FQZT0